Support, updates, and ongoing maintenance have been deprecated effective April 1, 2025, for:

1. Websites deployed before April 1, 2024, due to outdated frameworks that may no longer support the latest technologies and security standards

2. Websites that do not have a website maintenance or marketing contract in place.

We recommend you to assess your ongoing needs and explore our current plans.

7 new projects worth ₹55 billion approved by Government of India across TN, AP & MP — aimed at faster local production, reduced imports, and more skilled jobs.

This is where Quantazone helps:

With experience working across manufacturing and energy sectors, we provide AI-powered ERP, CRM, and cloud solutions tailored to your operational needs.

🔗 Learn more at quantazone.com

The Government of India has begun large-scale adoption of Zoho Workplace (email + office suite) across ministries and departments, under the “Swadeshi Digital” initiative.

Impact for business users:

• Strong endorsement of Made-in-India SaaS platforms

• Higher confidence in Zoho’s enterprise-scale capabilities

• Potential cost-/vendor-selection advantage for businesses using Zoho

🤝 As an official Zoho Partner, Quantazone helps you set up and tailor Zoho tools to streamline your business.

NITI Aayog has announced a 10-year roadmap to make Indian manufacturing smarter, greener, and more competitive.

It focuses on automation, faster approvals, and better digital infrastructure for factories.

Impact:

• New incentives for smart systems

• Easier compliance processes

• Stronger shift toward clean, tech-driven production

See how Quantazone’s ERP solutions help you stay aligned with India’s new manufacturing roadmap:

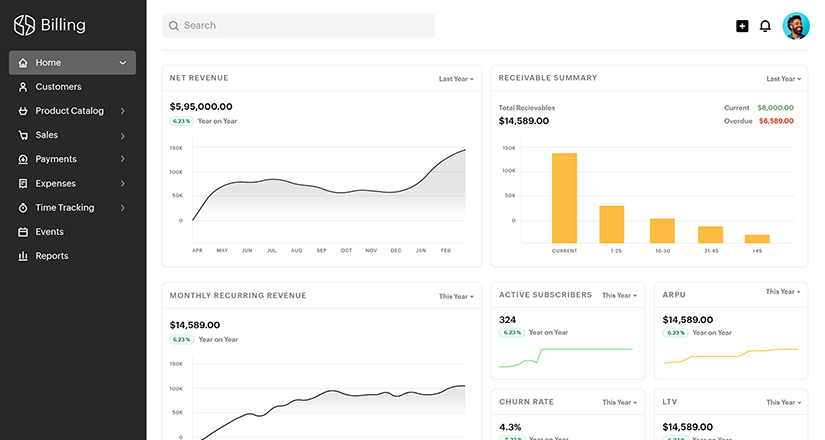

A recent industry survey shows that companies not using ERP/CRM/HRMS systems face slower decision-making and higher operational delays — especially in production and sales coordination.

Why this matters:

• Scattered data slows insights

• Manual follow-ups cause missed deadlines

• Teams react late instead of proactively

💡 See how Quantazone helps you connect your operations and make faster, data-driven decisions.

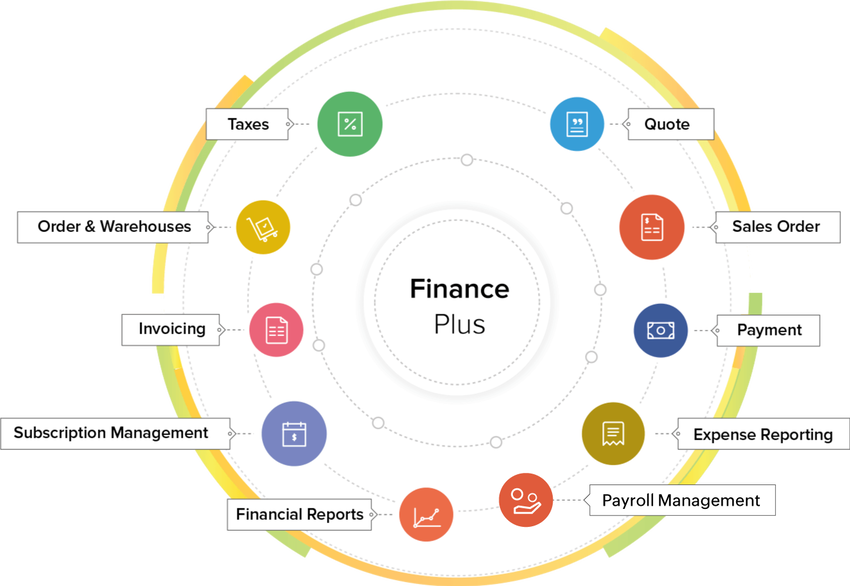

Say goodbye to piles of paper invoices! Eliminate paper delays and accelerate payments with digital invoicing and instant approvals. Bills are uploaded digitally, approvals move faster, and payments reach vendors on time. The result? Fewer delays, smoother cash flow, and a supply chain that never skips a beat.

Discover, Quantazone ERP Solutions

Streamline your workforce management and keep production running smoothly with easy shift scheduling! Supervisors can now assign shifts in just a few clicks! No more confusion about who’s working when- everyone sees their schedule instantly on mobile. This means smoother production flow and fewer last-minute changes.

To learn more, click here

The shop floor is now just a tap away! Workers can log downtime, defects, or safety checks directly from their phones, while managers view live dashboards showing production progress. No delays, no waiting for reports — just instant updates and faster action. Stay connected, stay in control.

For more information, visit quantazone.com

Introducing Zoho e-protect:

Zoho eProtect offers cloud-based email security and archival, acting as a gateway that shields your organization from spam, viruses, malware, phishing and advanced threats while enabling defensible archiving and eDiscovery.

With real-time scanning, seamless integration into existing IT systems, compliance-ready features, and a smart dashboard, it helps manufacturers reduce IT load, minimize downtime, and keep sensitive data secure every day.

Production costs, material usage, and budgets are now tracked in real time. Managers can spot waste early and take corrective action before it affects profits. This means tighter control over operations, smarter decisions, and more savings for the business. Every rupee counts, every process improves 📈

Visit, zohoanalytics